EV Tax Incentives are reshaping the automotive landscape, offering significant financial advantages to consumers who choose electric vehicles. This exploration delves into the various types of incentives available, their impact on consumer behavior and environmental policy, and their broader economic consequences. We’ll examine the current landscape, considering both successes and challenges, and project potential future developments in this rapidly evolving sector.

From federal tax credits to state-level rebates, a diverse range of financial support mechanisms exists to encourage EV adoption. This analysis will unpack the intricacies of these incentives, comparing their effectiveness across different regions and exploring their influence on market share. Furthermore, we will investigate the environmental and economic ripple effects of these programs, considering both the positive contributions and potential drawbacks.

Types of EV Tax Incentives

Navigating the landscape of electric vehicle (EV) tax incentives can be complex, as various federal and state programs offer different types of financial assistance. Understanding these differences is crucial for prospective EV buyers to maximize their savings. This section will clarify the various incentive types and their eligibility criteria.

The primary types of incentives available are federal tax credits, state-level rebates, and other programs like special financing or charging station incentives. These incentives differ significantly in their application, eligibility requirements, and the amount of financial assistance provided. Careful consideration of each program is essential to determine which best suits individual circumstances.

Federal Tax Credits

The federal government offers a significant tax credit for the purchase of new electric vehicles. This credit reduces the amount of income tax owed, rather than providing a direct rebate. The amount of the credit varies depending on the vehicle’s battery capacity and manufacturer’s suggested retail price (MSRP). Specific requirements, including income limits and vehicle type restrictions, are subject to change, so consulting the IRS website for the most up-to-date information is recommended.

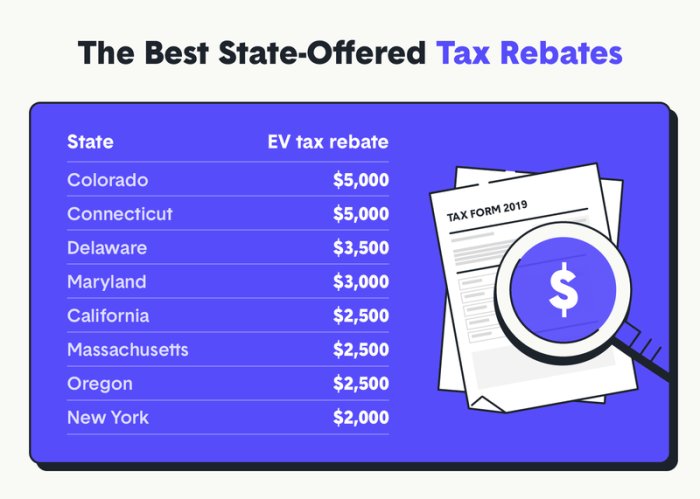

State-Level Rebates and Incentives

Many states offer additional incentives to encourage EV adoption. These incentives often take the form of direct rebates, reducing the upfront cost of the vehicle. Unlike federal tax credits, which are applied to your tax liability, state rebates are typically paid directly to the buyer at the point of purchase or shortly thereafter. Eligibility requirements vary significantly by state, including income limits, vehicle type, and residency requirements. Some states also offer incentives for installing home charging stations.

Table of EV Tax Incentives

The following table provides a general overview of some federal and state EV tax incentives. This information is for illustrative purposes only and should not be considered exhaustive. It is crucial to verify the most current details with the relevant state and federal agencies before making a purchase decision. Incentives change frequently.

| Incentive Type | Amount | Eligibility Requirements | Applicable States (Examples) |

|---|---|---|---|

| Federal Tax Credit | Varies based on battery capacity and MSRP (check IRS website for current details) | Purchase of new EV meeting specific requirements; income limits may apply; manufacturer limitations may apply. | All 50 states (but the amount received may be affected by state-specific regulations) |

| California Clean Vehicle Rebate Project (CVRP) | Varies based on income and vehicle type | California residents purchasing or leasing eligible EVs; income limits apply; vehicle type restrictions apply. | California |

| New York Drive Clean Rebate | Varies based on vehicle type and income | New York residents purchasing or leasing eligible EVs; income limits apply; vehicle type restrictions apply. | New York |

| Colorado Electric Vehicle Incentive Program | Varies based on vehicle type | Colorado residents purchasing or leasing eligible EVs; income limits may apply; vehicle type restrictions apply. | Colorado |

Note: This table is not exhaustive and incentive amounts and eligibility criteria are subject to change. Always check with the relevant state and federal agencies for the most up-to-date information.

Differences Between Tax Credits, Rebates, and Other Incentives, EV Tax Incentives

Tax credits reduce your tax liability, while rebates are direct payments. Other incentives might include preferential loan terms or access to charging station networks. For example, a tax credit might reduce your federal income tax by $7,500, while a rebate might provide a $2,000 check directly from the state. Preferential financing might offer a lower interest rate on an EV loan. Access to a charging network could be bundled with an EV purchase. These various options allow consumers to tailor their savings strategies to their individual circumstances.

Specific Requirements for EV Incentives

Income limits, vehicle type restrictions, and purchase deadlines are common requirements. For example, some state rebates may only be available to individuals with incomes below a certain threshold. Certain vehicle types, like plug-in hybrids or all-electric vehicles, may be eligible, while others may not. Additionally, many programs have deadlines for applications, requiring prompt action from interested buyers. Careful review of program guidelines is crucial to ensure eligibility.

Impact of EV Tax Incentives on Consumer Behavior

EV tax incentives significantly influence consumer purchasing decisions, acting as a powerful catalyst in the transition to electric vehicles. The financial benefit offered by these incentives directly reduces the upfront cost of purchasing an EV, making them more competitive with gasoline-powered vehicles. This reduction in price point is particularly impactful for consumers who might otherwise be hesitant due to the traditionally higher initial cost of EVs.

EV tax incentives demonstrably increase consumer demand for electric vehicles. The availability and generosity of these incentives create a more favorable purchasing environment, prompting consumers to seriously consider EVs as a viable transportation option. This effect is magnified when coupled with other factors such as growing consumer awareness of environmental concerns and advancements in EV technology leading to improved range and performance.

Market Share Comparison of EVs Across States with Varying Incentive Levels

A comparison of EV market share across states reveals a strong correlation between the generosity of incentives and EV adoption rates. Imagine a bar chart where the horizontal axis represents different states, categorized by the level of their EV tax incentives (e.g., High, Medium, Low, None). The vertical axis displays the percentage of EV market share in each state. States with “High” incentives would show significantly taller bars compared to states with “None,” illustrating a clear positive impact of incentives on market penetration. For example, California, with its robust incentive programs, would likely have a much higher bar than a state with minimal or no incentives, such as Mississippi. This visual representation would clearly demonstrate that generous incentives translate to higher EV market share. The data for such a chart could be sourced from organizations tracking EV sales and registration data by state, such as the Department of Energy or various automotive industry associations.

Successful Marketing Campaigns Leveraging EV Tax Incentives

Several successful marketing campaigns have effectively incorporated EV tax incentives into their messaging to boost sales. One effective strategy involves prominently displaying the total savings resulting from both the purchase price reduction and the tax credit in marketing materials. For example, an advertisement might state, “Get $7,500 off your new EV, plus an additional $7,500 federal tax credit – that’s $15,000 in savings!” This clear and concise messaging directly highlights the financial benefits to potential buyers. Another successful approach involves creating interactive online tools that allow consumers to calculate their potential savings based on their individual tax bracket and chosen EV model. This personalized approach increases engagement and reinforces the value proposition of EV tax incentives. Furthermore, some manufacturers have partnered with financial institutions to offer streamlined financing options that incorporate the tax credit directly into the loan terms, making the purchase process simpler and more attractive.

The Role of EV Tax Incentives in Environmental Policy

Electric vehicle (EV) tax incentives are a key component of many nations’ environmental policies, aiming to accelerate the transition to cleaner transportation and mitigate the detrimental effects of greenhouse gas emissions and air pollution. These incentives act as a catalyst, encouraging wider adoption of EVs and contributing to broader environmental goals. However, their effectiveness and overall impact are complex issues that require careful consideration.

EV tax incentives directly contribute to reducing greenhouse gas emissions by promoting the displacement of gasoline-powered vehicles. Internal combustion engines (ICEs) are significant contributors to carbon dioxide (CO2) emissions, a primary greenhouse gas driving climate change. By making EVs more financially accessible, tax incentives stimulate demand, leading to a larger number of EVs on the road and a corresponding reduction in CO2 emissions from the transportation sector. Furthermore, EVs contribute to improved air quality by eliminating tailpipe emissions of pollutants like particulate matter and nitrogen oxides, which are linked to respiratory illnesses and other health problems, particularly in urban areas. The cleaner air resulting from widespread EV adoption yields significant public health benefits.

Potential Drawbacks and Unintended Consequences of EV Tax Incentives

While EV tax incentives offer substantial environmental benefits, they are not without potential drawbacks. One significant concern is market distortion. Substantial tax breaks can artificially inflate demand for EVs, potentially leading to higher prices in the short term as manufacturers struggle to meet the increased demand. This could disproportionately benefit wealthier consumers who can more easily afford EVs even with the incentive, creating equity concerns. Another challenge lies in the potential for “greenwashing,” where manufacturers might prioritize meeting incentive criteria over genuine environmental innovation. For example, a focus solely on achieving emissions targets could overshadow the importance of sustainable battery production and end-of-life vehicle recycling. Furthermore, the effectiveness of tax incentives can be limited by factors such as the availability of charging infrastructure and consumer perceptions regarding EV range and performance. These factors can significantly influence consumer adoption, regardless of the financial incentives provided.

A Hypothetical Policy Scenario for Optimizing EV Tax Incentives

To maximize the environmental impact while mitigating negative consequences, a revised policy approach could incorporate a tiered system of incentives. This system would offer larger tax credits for EVs with demonstrably lower carbon footprints across their entire lifecycle, including manufacturing, battery sourcing, and end-of-life management. For instance, manufacturers using recycled battery materials or employing sustainable manufacturing processes could receive higher incentives. This approach would incentivize innovation in sustainable EV production and use, moving beyond simple sales targets. Simultaneously, the policy could incorporate a robust consumer education campaign to address concerns about range anxiety and charging infrastructure limitations. Furthermore, the government could invest in expanding public charging networks, particularly in underserved communities, to ensure equitable access to EV technology. This multi-pronged approach would address both environmental and equity concerns, ensuring a more sustainable and inclusive transition to electric transportation. For example, California’s Zero Emission Vehicle (ZEV) mandate, while not solely relying on tax incentives, demonstrates a similar approach by requiring automakers to sell a certain percentage of EVs, indirectly driving innovation and production.

Economic Impacts of EV Tax Incentives

EV tax incentives, while designed to promote environmental sustainability, also generate significant economic ripple effects across various sectors. These incentives not only stimulate the growth of the electric vehicle (EV) market itself but also influence related industries and create opportunities for job growth and investment. Understanding these economic impacts is crucial for policymakers to assess the overall cost-effectiveness and societal benefits of such programs.

EV tax incentives have a multifaceted impact on the automotive industry’s economic landscape. The incentives directly influence consumer purchasing decisions, leading to increased demand for EVs. This increased demand necessitates higher production volumes, triggering investment in manufacturing facilities, equipment upgrades, and the expansion of the workforce. Furthermore, the incentives encourage research and development into more efficient and cost-effective battery technologies and vehicle designs, further boosting economic activity.

Automotive Industry Job Creation and Investment

The surge in EV demand driven by tax incentives leads to substantial job creation within the automotive sector. This includes jobs in manufacturing, assembly, engineering, research and development, sales, and service. For example, the expansion of Tesla’s Gigafactories, partly fueled by government incentives, has created thousands of jobs in various locations. Increased investment in domestic manufacturing facilities reduces reliance on foreign production, strengthening national economies. Furthermore, the shift towards EV production necessitates the development of a skilled workforce, leading to increased demand for specialized training and education programs. This contributes to a more skilled and adaptable labor market.

Economic Ripple Effects on Related Industries

The adoption of EVs, facilitated by tax incentives, extends its economic benefits beyond the automotive sector. The growth of the EV market stimulates the development of supporting industries, notably the charging infrastructure and battery production sectors. The construction of charging stations generates jobs in installation, maintenance, and related services. Simultaneously, the demand for EV batteries drives investment in battery manufacturing facilities, creating jobs in mining, refining, and battery cell assembly. This interconnected growth creates a positive feedback loop, amplifying the overall economic impact of the incentives. For instance, the rise of companies specializing in fast-charging technology and battery recycling demonstrates this interconnected growth.

Hypothetical Cost-Benefit Analysis of EV Tax Incentives

A simplified cost-benefit analysis could compare the government’s financial investment in EV tax incentives with the long-term economic gains. Let’s assume a hypothetical scenario: The government invests $1 billion in EV tax credits. This leads to an increase in EV sales, resulting in $2 billion in additional tax revenue generated from increased manufacturing activity, sales taxes, and income taxes from new jobs. Furthermore, the reduction in air pollution due to increased EV adoption leads to decreased healthcare costs and improved worker productivity, adding another $500 million in economic benefits. In this hypothetical example, the total economic benefit ($2.5 billion) exceeds the initial investment ($1 billion), demonstrating a positive return on investment. This analysis, however, requires a comprehensive and detailed study incorporating various economic factors and potential externalities for a more accurate assessment. Such a study would need to consider factors like the lifespan of the vehicles, the long-term costs of battery replacement, and the environmental costs associated with battery production and disposal.

Future of EV Tax Incentives

The landscape of electric vehicle (EV) tax incentives is dynamic, constantly evolving in response to technological advancements, shifting environmental priorities, and budgetary realities. Current programs, while successful in boosting EV adoption, face increasing scrutiny and potential modifications in the coming years. Understanding these potential shifts is crucial for both policymakers and consumers navigating the transition to a cleaner transportation sector.

The sustainability of current EV tax incentive programs hinges on several factors. Technological advancements, such as improved battery technology leading to increased range and reduced costs, could diminish the need for such substantial government support. Conversely, stricter environmental regulations aimed at accelerating the phase-out of gasoline vehicles might necessitate continued or even expanded incentives to ensure a smooth transition. Budgetary constraints, however, present a significant challenge, forcing governments to prioritize spending and potentially leading to reduced incentive amounts or the sunsetting of certain programs. The interplay of these factors will determine the long-term viability of current incentive structures.

Potential Changes to Existing EV Tax Incentives

Several scenarios are plausible regarding future changes. We might see a shift from direct purchase rebates towards tax credits tied to vehicle features, such as battery capacity or domestic manufacturing. This approach could incentivize innovation and support domestic industries while potentially reducing the overall cost to taxpayers. Alternatively, we could see a phased reduction in incentive amounts over time, as EV adoption increases and market forces begin to drive down prices. For instance, some countries are already exploring this strategy, gradually lowering the amount of the subsidy as the market matures. Finally, there’s the possibility of geographic targeting, focusing incentives on specific regions or demographics to address disparities in EV adoption rates. This targeted approach aims to promote equity and ensure that the benefits of EV adoption are broadly shared.

Long-Term Sustainability of Current EV Incentive Programs

Predicting the long-term sustainability of current programs is challenging, but several factors suggest a potential shift. The increasing competitiveness of the EV market, driven by economies of scale and technological innovation, is likely to reduce the reliance on government subsidies. Furthermore, the growing consumer awareness of environmental benefits and the increasing availability of charging infrastructure could further accelerate EV adoption, making large-scale incentives less critical. However, maintaining a level playing field with internal combustion engine (ICE) vehicles, especially in the face of potential carbon taxes or stricter emission standards, might require continued, albeit potentially modified, government support. For example, the success of Norway’s EV adoption, initially heavily reliant on incentives, shows a gradual reduction in the need for such large-scale support as the market matures.

Alternative Policy Mechanisms for Promoting EV Adoption

Beyond tax incentives, several alternative policy mechanisms could effectively promote EV adoption. These include stricter emission standards for ICE vehicles, which would indirectly increase the competitiveness of EVs. Investing heavily in charging infrastructure development is another crucial step, addressing consumer range anxiety and making EVs more practical for a wider population. Government procurement policies, prioritizing EVs for public fleets, could also stimulate demand and drive down costs. Finally, regulations promoting the use of renewable energy sources for charging could further enhance the environmental benefits of EV adoption. A combination of these approaches, tailored to specific contexts and circumstances, would likely prove more effective and sustainable than relying solely on tax incentives in the long term.

Ultimately, the success of EV tax incentives hinges on their ability to balance environmental goals with economic realities. While these programs have undeniably spurred EV adoption, ongoing evaluation and adaptation are crucial to maximize their effectiveness and address any unintended consequences. Looking ahead, innovative policy approaches may be needed to ensure the long-term sustainability and broad accessibility of electric vehicle transportation.

FAQ Corner

What are the potential downsides of EV tax incentives?

Potential downsides include market distortions favoring certain manufacturers or vehicle types, equity concerns regarding accessibility for lower-income individuals, and the potential for budgetary constraints limiting program longevity.

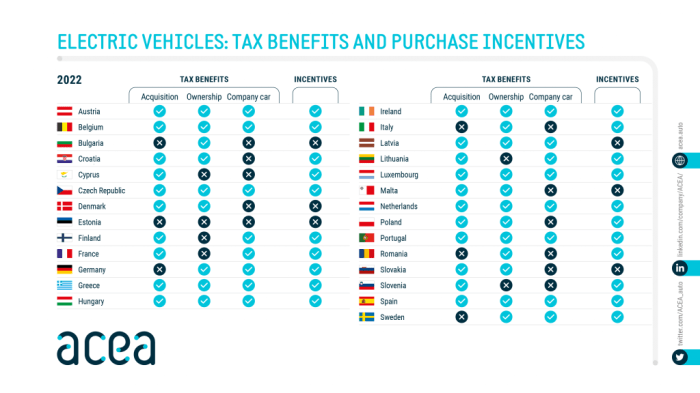

How do EV tax incentives compare internationally?

Incentive structures vary significantly across countries, with some offering more generous support than others. Factors influencing these differences include national energy policies, environmental priorities, and economic conditions.

Are there income limits for EV tax credits?

Yes, some federal and state EV tax credits have income limits, meaning only individuals or households below a certain income threshold qualify. These limits vary depending on the specific program.

What types of EVs are eligible for incentives?

Eligibility often depends on factors such as vehicle type (e.g., battery electric, plug-in hybrid), battery capacity, and manufacturing location. Specific requirements vary by incentive program.

How long will current EV tax incentive programs last?

The duration of current programs is uncertain and subject to change based on legislative action, budgetary considerations, and evolving policy priorities. Many programs have sunset clauses or are subject to annual appropriations.